Content

But a fee every month for for example a good removed-down family savings is annoying, as well as the best totally free examining account give much more constant benefits than just that one often after you have earned the main benefit. If you don’t have to miss out on financial incentives but cannot satisfy these types of standards, We have monitored down the very best checking account incentives one to don’t require direct deposit. For every of them, I examined the amount of the financial institution strategy plus the actions you need to to qualify for the brand new venture. I have and taken into account how much time it requires to receive your own extra once you qualify and you may detailed when per provide ends. Of a lot financial institutions pays your an indication-right up extra only to unlock a free account and you will satisfy conditions, and you do not always you would like direct put so you can qualify. Below are a few of the greatest financial bonuses currently available and you will how to be eligible for for every promotion.

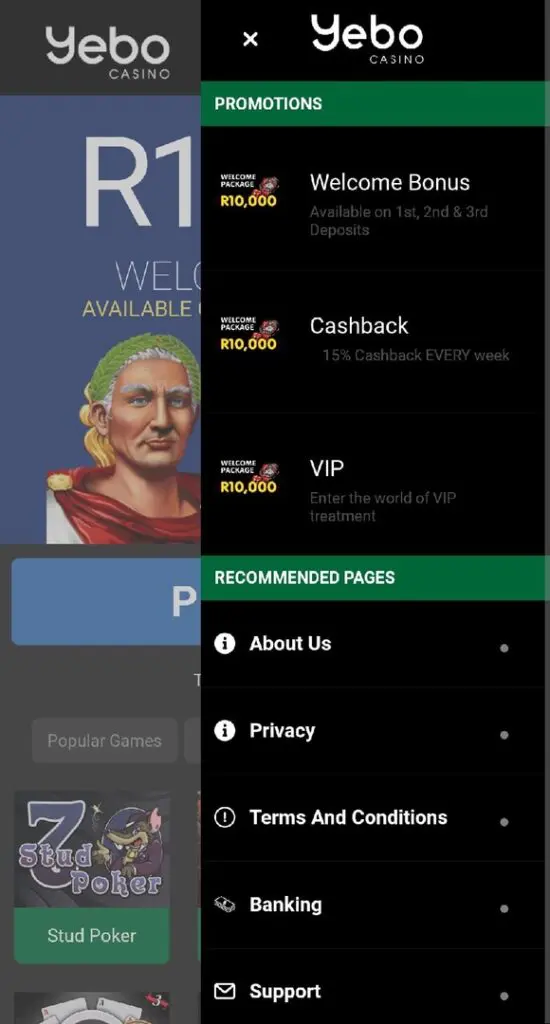

Small print out of a real income no-deposit incentives

Moreover it advances patient fulfillment from the minimizing delays and you can reducing stress for both clients and you can caregivers. From a working perspective, they optimizes arranging and you will improves financing usage, along with team day, endoscopy room access, and you can reprocessing workflows. Simultaneously, it assists lower staffing will set you back by reducing the need for overtime and you can contributes to a more powerful place of work from the minimizing worry and you will burnout certainly one of health care team. H/L customers had been far more gonna statement large‐chance SDOH metrics, along with useless caregiver wellness literacy and you will liking for a code almost every other than English (Desk 2). Even though H/L clients shown greater risk round the really SDOH metrics, such differences weren’t mathematically significant, potentially on account of short test versions.

“Today’s one-fourth-part cut to Lender Rates acquired’t flow the borrowed funds business drastically, however it does support the downward impetus supposed. Lenders will likely slender cost then to keep competitive, particularly with already rates in another reduce through to the stop of the year. But not, home-based sale at the high LTVs, in addition to shared possession and you can combined debtor just proprietor selling, provides fallen in cost by up to 0.27 percentage items. Loan providers continue to adjust fixed speed prices each other upwards and you can downward, as the mindset to own rates of interest is unclear but battle in this particular sectors of one’s field remains brutal, writes Jo Thornhill. Benefits trust higher than requested rising cost of living and you can lowest economic progress rates you’ll push the financial institution of The united kingdomt to store the fresh benchmark Financial Rates large for extended. However, it means some lenders, who had aggressively slash the repaired mortgage prices inside expectation away from shorter drops inside the rates of interest, are actually modifying those people rates back-up again.

Just what are gambling enterprise no deposit incentives?

No-deposit gambling establishment bonuses come with of many legislation and you will limits, including restriction wager restrictions and betting requirements. If not gamble relative to these types of restrictions, the brand new local casino is decline to pay your profits. As well as, there might be an optimum cashout code set up, and this limits just how much a real income freespinsnodeposituk.org look at here you could potentially withdraw, and you should make use of very own and you will truthful suggestions whenever creating your local casino account. With an array of no-deposit now offers listed on which page, you may find it tough to pick the best choice for you. So you can make an informed choice, we’ve achieved the main information about all available incentives as well as the casinos providing them. Make use of this analysis to compare the new indexed free local casino incentive also provides and pick your chosen.

Procedural and you can diligent‐top services that will determine choice‐and make just weren’t explored outlined. No significant difficulty have been stated in just just one inconsequential mucosal burns which had been signed which have movies. The patients had an excellent fluoroscopic evaluate investigation proving unchanged mucosal closing instead of problem to your blog post‐operative day (POD) 1 and you will launch to your POD1. Profile 2 suggests colectomy rates peaking during 2009 (0.05 for every 100,000 patient‐years) which have a drop within the PostB point in time (2012–2022).

Greatest No-deposit Gambling enterprises in america

The greatest-spending Cd rates at this time can be obtained during the California Coastline Borrowing from the bank Union. To become a member and open a certification, you ought to alive, performs, or go to college or university inside Hillcrest otherwise Riverside areas. Cd ladders will help mitigate the risk which you can need to withdraw your own fund through to the CD’s name size is actually upwards.

What’s the attained income tax borrowing?

A much deeper reduce might possibly be invited from the individuals, including the individuals coming to the conclusion fixed rates sales within the the newest coming days. Skipton has reduce the private earliest-go out consumer four-12 months fixed price offer to own borrowers with a ten% deposit (90% LTV) in order to cuatro.89% (down out of 5.25%). Tomorrow will even comprehend the release of HSBC’s the newest quality financial variety to own fund really worth more £2 million. Selling will come that have a good £1,999 scheduling commission and will be open to household movers, first-date people and remortgage consumers, that have at least an excellent twenty-five% cash put or security in their house (75% mortgage so you can well worth). Barclays is cutting the price of selected domestic repaired-rates sales, for brand new and you can existing individuals, by the around 0.5 payment things, energetic away from tomorrow (11 Oct). One-12 months repaired rates try unusual in the business, with just two expert loan providers providing this type of deal.

Now, you can enjoy the initial gambling training which have webpages credit inside their local casino profile and you will check out highly rated online casinos to help you discover and that consumer experience you adore greatest. Register to your our required gambling establishment web sites to allege the brand new no deposit bonuses just before they expire. Yet not, another chill promo trapped our eyes within the review – and is also nearly of the same quality. Everything you need to perform is actually make a deposit and bet $5 and you can discover $50 inside casino credit to your membership.

Compare family savings offers

NatWest made decrease all the way to 0.1 payment items around the its purchase and you may remortgage product sales for new customers, but chosen four-year repaired rate selling have increased by the to 0.03 fee issues. Virgin Currency, owned by Across the country building neighborhood, has grown chosen four-season repaired rates for purchase and you can remortgage because of the to 0.14 fee points. Chosen five-12 months device transfer fixed costs have been enhanced by to 0.step 1 commission items. Gen H, the newest professional lender for earliest-go out buyers, features lowered the cost of chosen two-seasons fixed rates, in addition to reducing its 90% mortgage to really worth bargain by the 0.step 3 fee points to 5.94% having an excellent £1,499 payment. So it bargain can be found to help you very first-time people taking Gen H’s homebuyer package, with legal advice.

Ally Lender Savings account

The newest disperse will bring the financial institution’s low rate for purchase as a result of market-leading 3.96%, writes Jo Thornhill. The fresh Accord sales, readily available because of brokers, try payment-totally free five-seasons repaired costs, and therefore range from 5.19% (to have consumers having a good 10% deposit). Cashback of £dos,500 are paid for the property pick to £3 hundred,000, after which tiered around a total of £six,250 for the possessions purchase of £five-hundred,one hundred thousand. United Faith Lender, the newest expert financial, has cut chose BTL product sales from the up to 1.76 fee issues.